Stock Market Mastery Bootcamp

No Jargon. Real Learning. Actual Implementation.

A practical, 4 week live bootcamp designed for beginners to learn how to analyze stocks like a pro and build profitable portfolios.

Why I What I Where I Who I How

🔥Tired of Confusing Fancy Finance Terms?

🔥Lost Money in Tips and F&O Trading?

🔥Want a Simple System That Works?

🧠Learn Real Stock Market Analysis and Investing

⚒️No Jargon, Just Results

🎯Made simple for beginners.

🛣️Made smart for serious learners.

🛠️Engineer by training

💹Investor by obsession

🤝Mentor by choice.

I’m Subhash Chandra Sonbhadra — an IIT Madras alumnus who walked away from the comfort of consulting to dive deep into the stock market. Today, I’m a full-time investor and financial strategist with systems that I’ve battle-tested through market cycles.

This bootcamp isn’t just theory — it’s everything I wish I had when I started. No guesswork. Just clear, actionable methods to help you invest with confidence — and results.

What We Will Learn!!!

Basics of Wealth Creation

“It’s not about how much you earn—it’s about how well you grow what you have.”

In this module, you’ll understand:

- 🌱 The power of saving, investing, and compounding

- 🧠 Why rich people focus on assets, not just income

- 🚀 How investing early—even with small amounts—can change your life

This sets the mindset shift that turns a spender into a wealth builder.

Magic of compounding

“Compounding is the 8th wonder of the world. Master it, and you don’t work for money—money works for you.”

You’ll learn:

- 🔢 The math of doubling your money through time, not luck

- ⏳ Why time in the market beats timing the market

- 📈 Simulation of how ₹5,000/month can turn into crores

You’ll never look at money the same way again.

Why Stock Market

“You don’t need to be a trader to win. You just need to be smart and consistent.”

Here, we’ll cover:

- 📊 Why equities are the most powerful long-term wealth creators

- 💥 The difference between investing and gambling (cash vs derivatives)

- 🚫 The myth of getting rich quick with options/futures—and the real risk

By the end, you’ll be confident in taking the safer, smarter equity route.

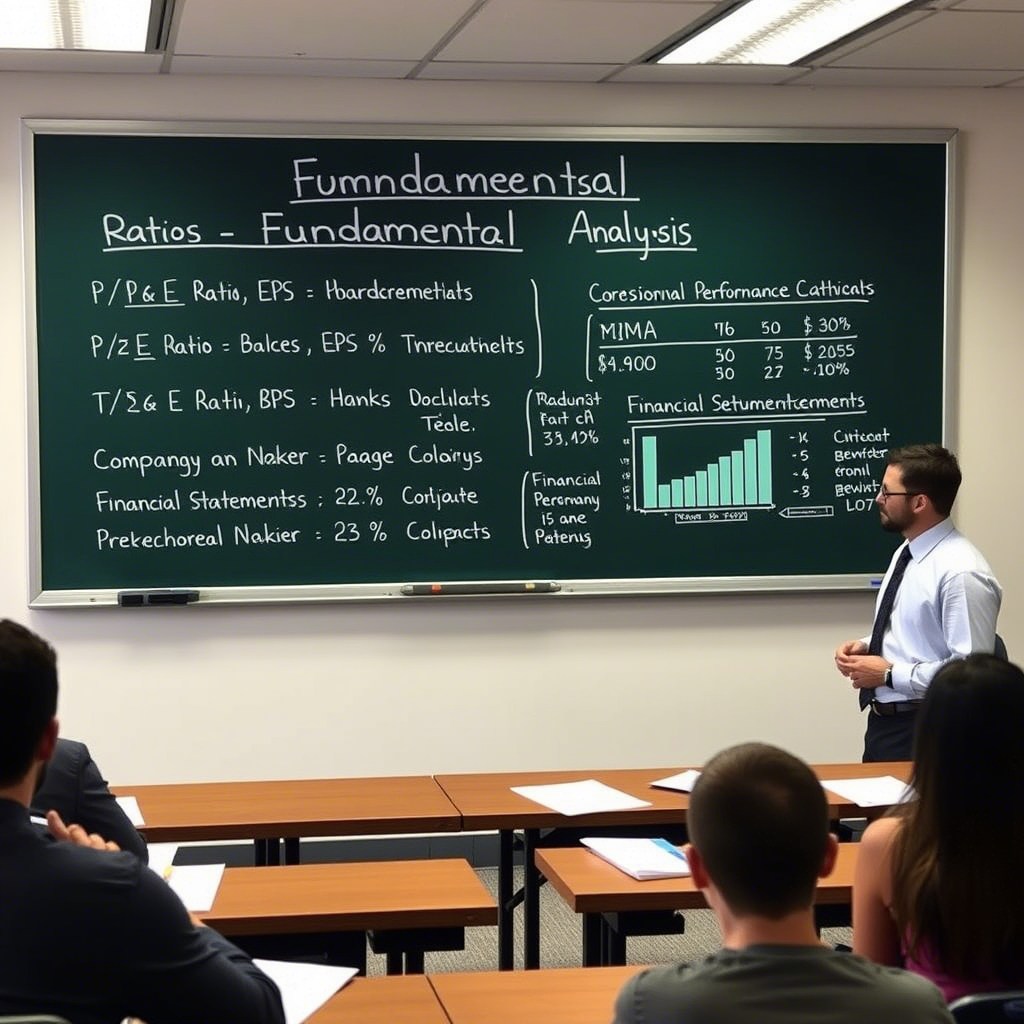

Fundamentals Made Easy (Fundamental Analysis)

“Great businesses build wealth. We’ll show you how to find them.”

You’ll learn:

- 📚 How to read key parts of a company’s financials (even if you’re not from finance)

- 💸 What makes a company profitable, efficient, and investable

- 🧠 Key ratios like ROCE, Debt-to-Equity, and Earnings Growth explained simply

- 🔍 Screener.in-based hands-on screening of real stocks

You’ll be surprised how easy it is once you know what to look for.

Basics of Technical Analysis

“Technicals are the X-ray of price—they show you the mood of the market.”

This will include:

- 🧭 Trend analysis: Learn how to follow the direction of the market

- 📊 Indicators like RSI, MACD, and Moving Averages (kept simple)

- 🏗️ Support & resistance levels, chart patterns, and volume analysis

- ✅ Entry & exit signals based on price action

This will empower you to time your buys and sells smartly, even as a long-term investor.

Tools You’ll Use (Hands-on)

“You don’t need Bloomberg Terminals. You need the right free tools—and how to use them.”

You’ll work hands-on with:

- 🔎 Screener.in – for stock filtering and financial data

- 🧾 Tijori Finance – for deep insights into business models

- 💹 TradingView – for charting and technical setups

- 📈 NSE/BSE official sites – for announcements, filings, and investor updates

You’ll walk away with a full research toolkit.

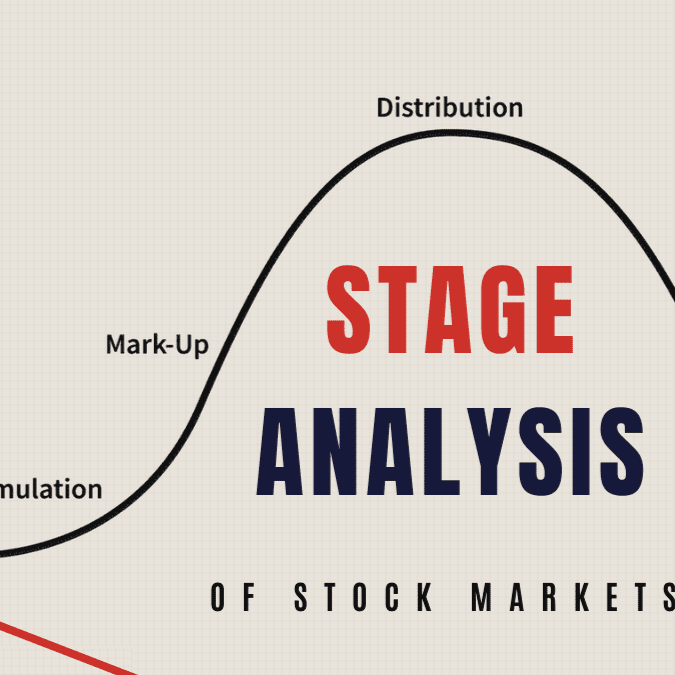

Stage Analysis

Most beginners lose money because they invest at the wrong time.

In this bootcamp, you’ll learn:

🔍 How to read sector rotation and align your portfolio with the strongest sectors

🔄 How to identify the four market stages – Accumulation, Uptrend, Distribution, and Downtrend

📉 How to avoid buying at tops and selling at bottoms

Risk Management

“The goal is not just to make money, but to stay in the game.”

You’ll learn:

- 🛡️ Position sizing: How much to invest in each stock based on your capital and conviction

- 📊 Diversification: How to balance risk by choosing uncorrelated stocks across sectors

- ⛔ Stop-loss logic: How to exit without emotions when the thesis is invalidated

- 📉 Risk vs reward: Every trade or investment you make will have a defined potential upside and downside

This ensures your downside is protected, and your upside can grow exponentially.

Creation of Buy-Add-Sell System

Say goodbye to confusion. Build a clear, repeatable decision-making system:

- 📥 Buy Criteria: When to enter a stock (based on fundamentals, Technical, or both)

- ➕ Add Criteria: When to average up confidently (not blindly at dips)

- 📤 Sell Criteria: When to partially or fully exit based on:

- Price targets

- Trend reversals

- Sector rotation

- Risk-reward rebalancing

You’ll build your own playbook, guided by Our proven methods—and refine it with real-time examples during the bootcamp.

Bonus

WEAPON Framework

A proven framework based on CANSLIM to identify high-potential stocks using a blend of momentum, earnings, profitability, news, and more.

You’ll learn:

- How to spot stocks at the right time in the right sector

- How to rank stocks using a simple yet powerful system

- How to make data-driven, bias-free decisions in minutes

This turns your research into a repeatable and confident process.

Exclusive Buy-Add-Sell System

Tired of asking “Should I hold or sell?” This system answers it for you.

You’ll Get:

- 📥 A ready working entry strategy based on charts + fundamentals

- ➕ Averaging logic to scale your position smartly, not emotionally

- 📤 Clear exit rules to lock profits and cut losses without confusion

You’ll walk away with a battle-tested decision system.

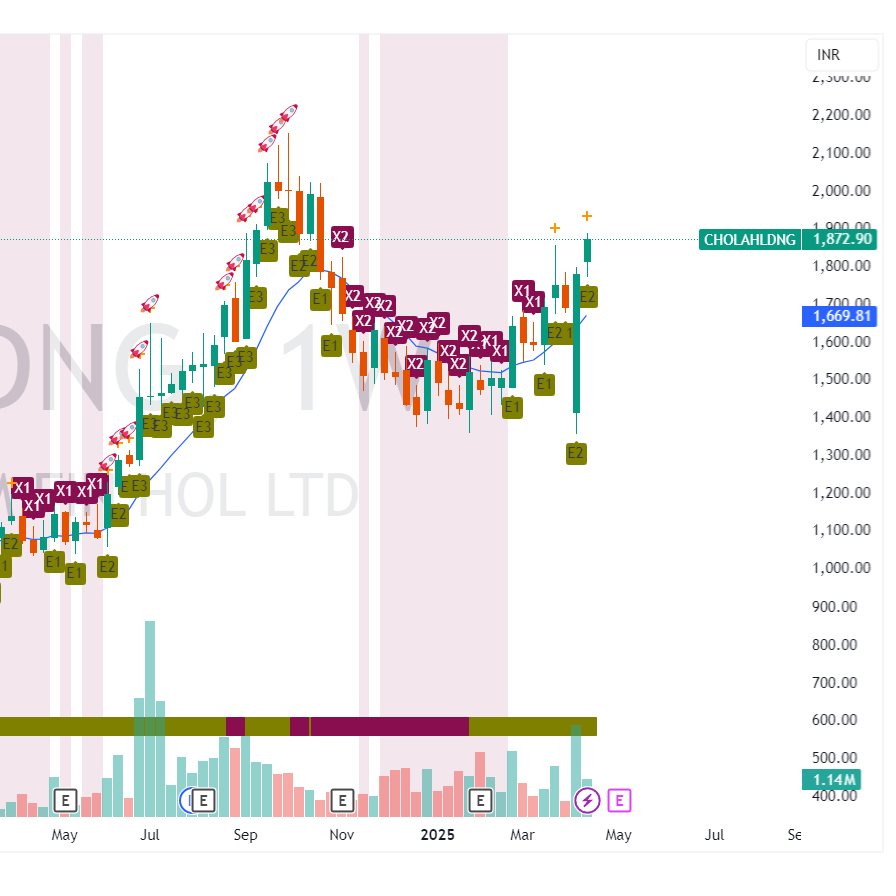

Custom TradingView Indicator access for 3 months

Get exclusive access to a proprietary TradingView indicator

- 🧠built by me using PineScript, designed to give you a visual edge in spotting winning trades.

- 🌟This isn’t just another indicator — it’s your ready-to-use market scanner

You’ll get full access to this TradingView indicator for 3 months, so you can practice, experiment, and trade with confidence — using the exact tools I use in my personal trades.

Portfolio Health Check & Assessment

Before building new positions, let’s fix the foundation.

You’ll get:

- A complete review of your existing holdings

- Clarity on what to hold, exit, or re-structure

- Suggestions on diversification, allocation, and risk

This sets the stage for a clean, strategic portfolio.

Personal Investment Journal Template

Discipline beats intelligence. This tool will keep you consistent.

You’ll receive:

- A digital journal to record your trades, logic, results, and emotions

- Sections to note learnings and patterns

- Helps you build a second brain for investing

This habit alone can boost your performance dramatically.

Personal Handholding & Mentorship

You’re never alone in this journey.

During and after the bootcamp:

- Get priority doubt support via our Telegram/WhatsApp group

- Join a tribe of learners who are also building wealth like you

- Access Q&A responses, shared analysis, and checklists

You’ll feel guided and backed, every step of the way.

Ultimate Rewards on Completion of the Course

Weekly Market Insight Emails

Every week, you’ll receive:

- Sector rotation updates

- Market mood analysis

- Key charts and economic triggers

Stay in sync with what matters, without wasting hours in news.

Access to Weekly Live Market Calls – For 1 Year

A one-hour weekly session to sharpen your skills and catch real opportunities.

We’ll cover:

- Live chart reviews

- Upcoming themes & sectors

- Open Q&A + discussion of member portfolios

It’s like a weekly refresher + mini masterclass.

Doubt Clearance & Q&A Support for 1 Year

Learning never stops, so:

No confusion left unresolved

Drop your questions even after the course ends

Get replies via chat or during live sessions

By the End of This Bootcamp

You Will Be Able To…

🔍 Understand how real wealth is created and why the stock market plays a powerful role

📚 Grasp the basics of compounding, asset classes, and why equity beats inflation

🧠 Think like an investor, not a trader — no FOMO, no gambling

💡 Analyze stocks using fundamental metrics like a pro

📈 Read technical charts and patterns to time your entries and exits better

⚙️ Use top tools like TradingView, Screener, TijoriFinance with ease

🔐 Apply the WEAPON Framework to find, filter, and finalize strong stocks

🧩 Build your own Buy-Add-Sell system — no more guesswork

🚨 Spot key levels like support, resistance, breakouts, and trends with our custom indicator

🛡️ Manage risk like professionals using proper position sizing and capital allocation

🧭 Track your investments with a personal trading journal system

🤝 Ask questions, get feedback, and learn from real-world examples with personal handholding

📊 Build a portfolio that reflects your goals — not some template allocation

🔁 Understand market cycles, sector rotation, and stay ready for every opportunity

🎯 Make independent investment decisions — confidently and consistently

Fundamental Analysis

Lorem ipsum dolor consectetur adipiscing elit eiusmod.

Technical Analysis

Lorem ipsum dolor consectetur adipiscing elit eiusmod.

Risk Management

Lorem ipsum dolor consectetur adipiscing elit eiusmod.

WEAPON Framework

Lorem ipsum dolor consectetur adipiscing elit eiusmod.

“If you don’t find a way to make money while you sleep,

you will work until you die.”

– Warren Buffet

Why Choose Us

Passionate

Tempor ullamcorper urna, est, lectus amet sit tempor pretium mi sed morbi cras posuere sit ultrices bibendum augue sit ornare.

Professional

Tempor ullamcorper urna, est, lectus amet sit tempor pretium mi sed morbi cras posuere sit ultrices bibendum augue sit ornare.

Support

Tempor ullamcorper urna, est, lectus amet sit tempor pretium mi sed morbi cras posuere sit ultrices bibendum augue sit ornare.